delayed draw term loan accounting

A short-term loan is categorized as a current liability whereas the unpaid portion of a long-term loan is shown in the balance sheet as a liability and classified as a long-term. Our publication A guide to accounting for debt modifications and.

Debt Contract Enforcement And Conservatism Evidence From A Natural Experiment Aghamolla 2018 Journal Of Accounting Research Wiley Online Library

Typically the escrow deposit.

. The borrowing of the Delayed Draw Term Loan A is subject to satisfaction of certain conditions including without limitation the consummation of the Acquisition. Provided however that on the. THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE.

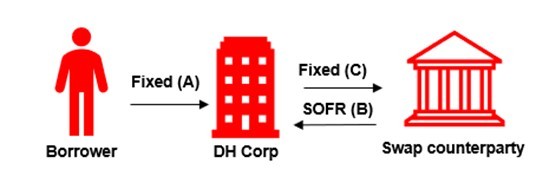

A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another unrelated. A deposit in escrow also an escrow deposit is a type of deposit that one party must make further to the terms of a mutually signed agreement.

An upfront fee paid to the lenders on a term loan is a straightforward example of a payment from the borrower to the lender that is not a payment for services provided by the. Determine if the borrower is experiencing financial difficulty ie is the borrower actually. The DDTL typically has specific time periods such as three six or time months for.

A Delayed Draw Term Loan borrowing may consist of Alternate Base Rate Loans or LIBOR Rate Loans or a combination thereof as the Borrower may request. The accounting implications differ depending on whether the borrowers or lenders accounting is being considered. DELAYED DRAW TERM LOAN AGREEMENT.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again.

Another name for the Exchange Act. Prior to April 2015 financing fees were treated as a long-term asset and amortized over the term of the loan using either the straight-line or interest method deferred financing fees. While you may enjoy the flexibility and save money on.

DDTLs were used in bespoke arrangements by borrowers. The lenders approve the term loans once with a. DDTLs are usually used by businesses that would like to purchase capital refinance debt or make acquisitions.

Key Takeaways A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined. Another name for the Securities Act. An accordion feature in a line of credit allows a business to increase that line of credit if necessary often to obtain more working capital or emergency cash.

Another name for a Tranche A. AND RESTATED DELAYED DRAW TERM LOAN AGREEMENT dated as of October 18 2019 the Restatement Date is by and among SHIFT TECHNOLOGIES INC a Delaware corporation. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the.

Determining whether a loan modification constitutes a TDR is a two-step process. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of.

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Another name for the Investment Company Act. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time.

The Impact On Long Term Capital Investment Of Accounting And Prudential Standards For European Financial Intermediaries Cairn International Edition

Delayed Draw Term Loans Financial Edge

Financing Fees Deferred Capitalized Amortized

Environmental Accounting Practices And Investment Decisions Decision Of Quoted Food And Beverage Companies In Nigeria Grin

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Highlights Transactions Careers Community Houlihan Lokey

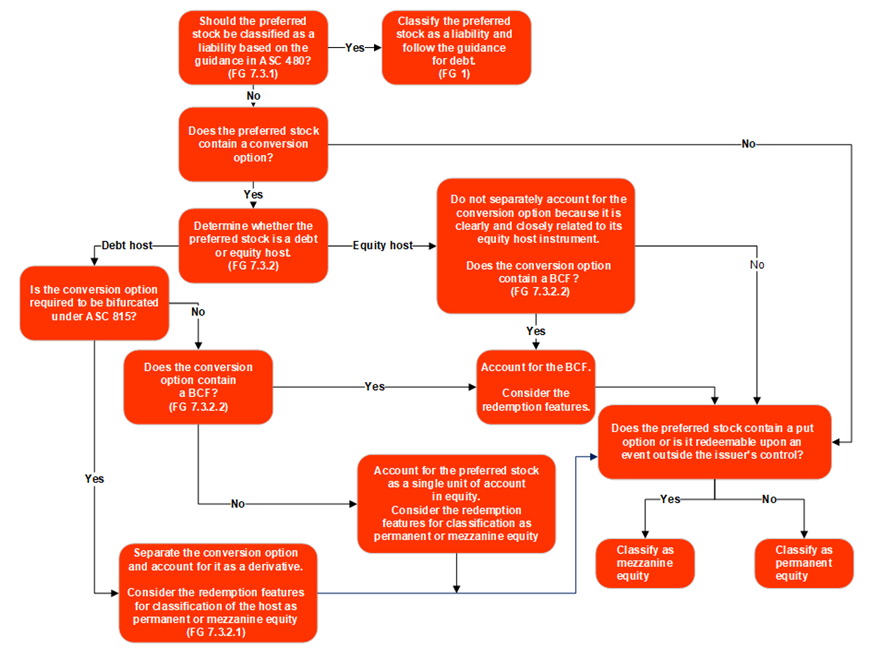

7 3 Classification Of Preferred Stock

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Full Article Reporting Matters The Real Effects Of Financial Reporting On Investing And Financing Decisions

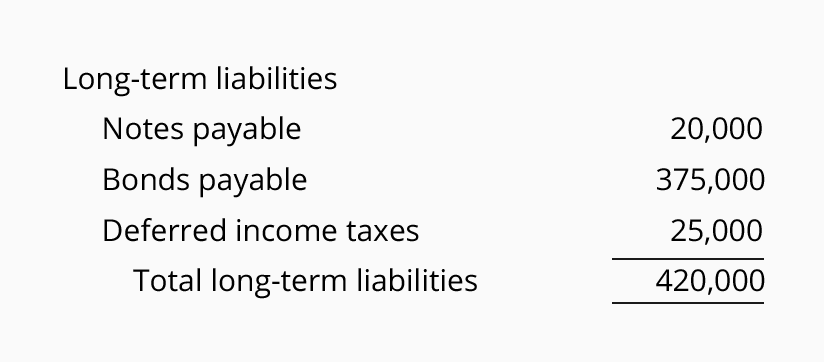

Balance Sheet Long Term Liabilities Accountingcoach

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

/GettyImages-175520675-fad3bb7af6aa4da48f02d47ba57a7432.jpg)